CRACKED VCA BIAS-FREE TECH & VENTURE ECOSYSTEM

Traditional VC bias burns $4T in potential each year so we built the first meritocratic public market for cultivating outliers, aimed at recovering a portion of that capital from its fiery fate.

CRVCT provides an equitable, data-driven path from training to funding for talent while simultaneously producing superior deal flow for investors by de-risking our founders + flagging high-potential deals the traditional system routinely filters out.

VC BIAS FOMENTS FIDUCIARY NEGLIGENCE

Rife with uncertainty, traditional VC relies on a narrow set of proxies: Privilege, Proximity, Pedigree, Prestige, & Pattern, to quickly filter talent and de-risk investments. A practice that excludes the very talent who statistically deliver the greatest returns and possess the highest growth and earning potential.

According to "The Trillion-Dollar Blind Spot", a report published by Morgan Stanley (2019)—

VC's entrenched systemic exclusion costs the US $4.4 trillion in missed innovations annually.

AND THE DATA IS DAMNING:

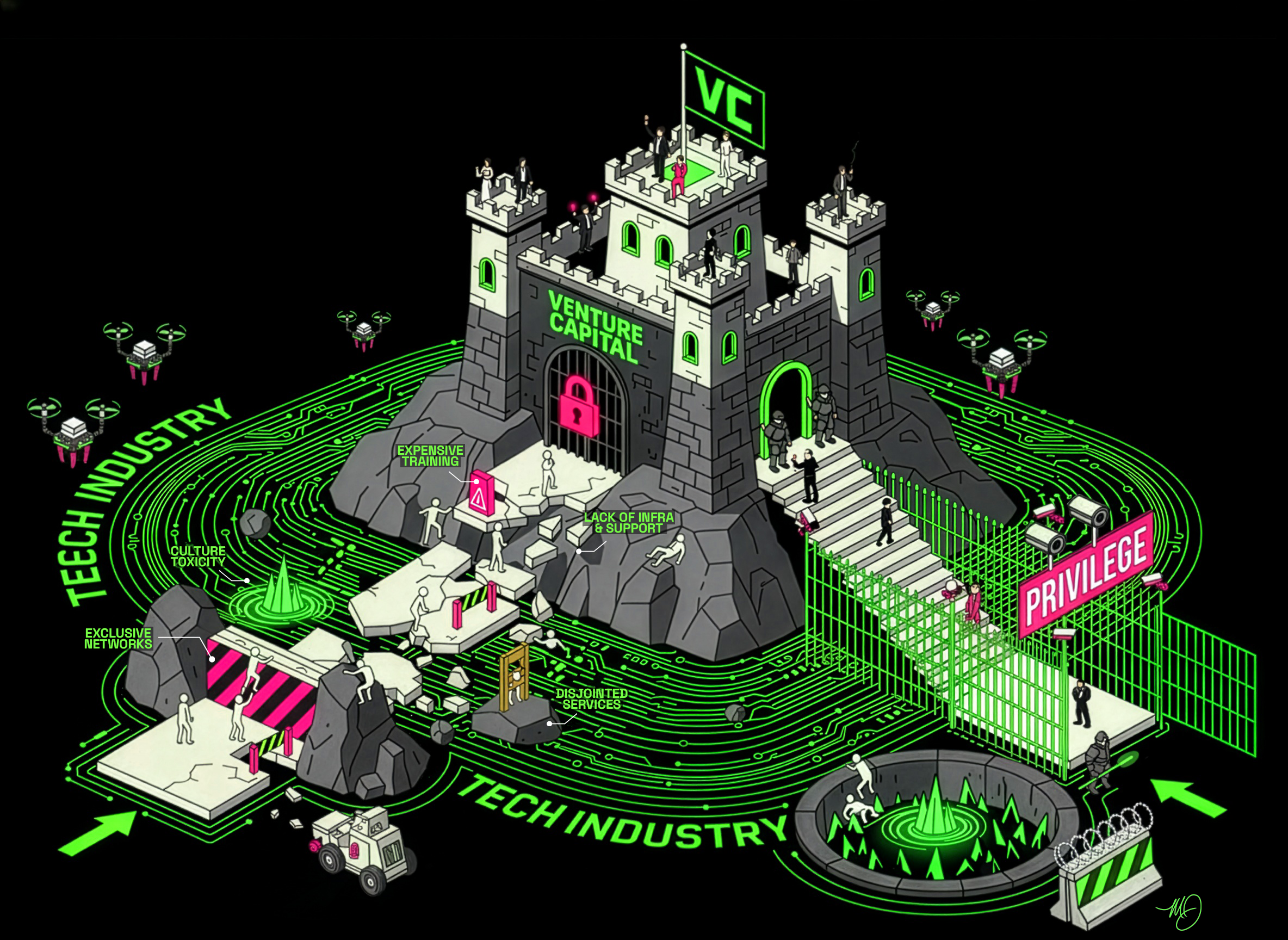

A FORTRESS WITH A MOATTHE STORY OF THE CASCADE OF EXCLUSION

Venture capital is a fortress; its bias is the gate, and its moat is the tech industry itself.

For outliers, the path to funding is an unforgiving gauntlet.

While VC bias is the core problem we solve for, the hostile tech landscape, with its prohibitive costs, exclusive networks, and disjointed services, is a preliminary layer of systemic exclusion that we also solve for.

THE $4T BLIND SPOT

Were the market to invest in WMBEs proportionate to their share of the labor force, it would capture the $4.4 Trillion in missed innovation currently being left on the table each year.

$240B+

Average Annual Deployment U.S.

How $4.4T is Calculated:

THE $39B PORTION

The $4.4T blind spot is our mandate. Our focus is the high-potential talent being overlooked and the forward-thinking investor open to a smarter, data-driven approach to de-risking deals.

We are targeting a $39B Serviceable Obtainable Market (SOM), comprising:

US-Based "Outliers"*

The national population of Gatekept and Overlooked talent.

Accredited Investors

A verified pool of investors already aligned with our mission.1

Black Women

A critical cohort pushed out of the workforce, representing immense, immediate talent.2

This is not a theoretical opportunity. It is a defined market of users and capital, systematically excluded by traditional VC and waiting for the platform we've built.

CRVCT: PROOF OVER PROXIES

CRVCT is a vertically integrated solution that replaces VC's outdated, biased, and fiducially negligent processes with an algorithmic, meritocratic, and fiducially diligent ecosystem, anchored by our Proof-of-Worth consensus, enabling our members to build an on-chain reputation that we algorithmically convert into two powerful outputs:

FOR TALENT & FOUNDERS

Converts non-economic capital (hustle, skill, insight, and impact) into $CRVCT utility token, creating tangible ecosystem equity.

FOR STEWARDS & INVESTORS

Generates a venture-grade Signal Score, de-risking investments by replacing biased proxies with verifiable performance data.